In the vast and ever-evolving landscape of digital finance, the security and validity of payment methods stand paramount. With billions of credit card transactions occurring daily worldwide, the need for reliable tools to verify these crucial financial instruments is undeniable. This is where applications like the Credit Card Checker, developed by Blueice, step in, offering a streamlined solution for users seeking to validate credit card information efficiently.

This comprehensive article delves into the specifics of the Credit Card Checker, exploring its features, user base, technical specifications, and its broader significance within the realm of productivity software. We will also examine how platforms like PhanMemFree play a vital role in curating and providing access to such essential tools, ensuring their safety and accessibility to a global audience.

Introduction to Credit Card Checker

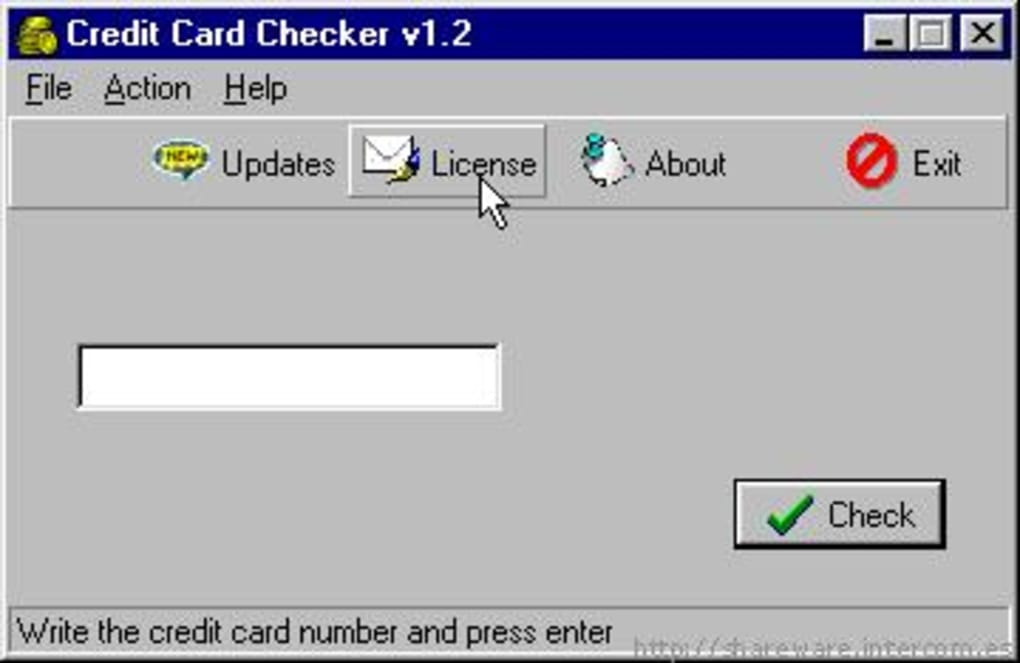

The Credit Card Checker is presented as a valuable, free productivity software specifically designed for the Windows operating system. Developed by Blueice, it serves a fundamental purpose: to check whether a credit card number is valid. While the name might suggest a simple utility, its implications for both personal financial management and small business operations are considerable, making it a noteworthy addition to any digital toolkit.

Upon first impression, the software is lauded as a “good, free program.” This designation immediately highlights two key attributes that appeal to a broad user base: its utility and its cost-effectiveness. In an era where digital security is a growing concern, having a dedicated tool that can assist in basic credit card validation without incurring additional expense is a significant advantage. Its classification under “Productivity software” further indicates its role in streamlining tasks and improving efficiency, rather than being a standalone entertainment or niche application. For anyone dealing with credit card numbers, whether for personal organization, testing development environments, or minor business verification, a tool like the Credit Card Checker offers a direct solution to a common need.

The journey of the Credit Card Checker began in 2012 when it was first added to PhanMemFree’s extensive catalog. Since its inception, it has garnered substantial attention, achieving over 41,721 downloads. This demonstrates a consistent demand for such a utility over the years. Even in recent times, with six downloads recorded in a single week, its relevance persists, underlining the ongoing need for simple, reliable credit card verification. This enduring popularity speaks volumes about its effectiveness and the continuous demand for accessible security tools in the digital age.

Delving into its Features and Performance

The effectiveness of any software is often determined by its technical design, its reach, and its consistent performance. The Credit Card Checker excels in several of these areas, making it a reliable choice for its intended audience.

Lightweight Design and System Compatibility

One of the standout characteristics of the Credit Card Checker is its remarkably light footprint. The application does not demand extensive system resources or storage space, requiring significantly less memory than many other programs categorized under “Productivity software.” This attribute is particularly beneficial for users operating older Windows systems or those who prefer to keep their software installations lean and efficient. Its minimal resource consumption means it runs smoothly without bogging down the system, allowing users to perform their validation tasks quickly and without interruption.

Regarding system compatibility, the Credit Card Checker is designed for users operating Windows 95 and all subsequent versions. While Windows 95 might seem like an archaic operating system in today’s context, this broad compatibility ensures that the software can function across a vast spectrum of Windows environments, from vintage machines to more contemporary setups, although its primary target would likely be systems preceding the most modern Windows iterations where resource efficiency remains a critical factor. The fact that it is exclusively available in English further defines its target demographic, focusing on the majority of users who operate in this language globally. The current version of the program is 1.3, with its last known update occurring on June 17, 2012, indicating that while it may not receive frequent updates, its core functionality has remained stable and sufficient for its purpose.

Global Reach and User Adoption

The download statistics for the Credit Card Checker underscore its global appeal and utility. The software is frequently downloaded in diverse countries such as India, the Russian Federation, and the United Kingdom. This geographic spread is indicative of a universal need for basic financial validation tools, transcending regional digital landscapes and economic contexts. The fact that users in these varied markets consistently seek out this particular application highlights its effectiveness and perhaps its straightforward approach to a common problem.

The consistent download figures since 2012, culminating in thousands of installations, paint a picture of a tool that has successfully carved out a niche for itself. While newer, more feature-rich alternatives may exist, the Credit Card Checker’s enduring presence suggests that its simplicity, coupled with its free availability, remains a powerful draw. This sustained adoption rate speaks to its reliability and the trust users place in its core functionality for credit card verification.

Exploring the Competitive Landscape

While the Credit Card Checker provides a straightforward solution, it operates within a broader ecosystem of financial and productivity tools. It’s useful to understand how it stands in relation to similar applications, which often offer more specialized or advanced functionalities.

For instance, “Ultimate Credit Card Checker Pro” is presented as an app that also checks whether a credit card is valid, but it’s a trial version, suggesting a premium offering with potentially more features or a more robust validation engine. The “Pro” in its name often implies advanced capabilities, perhaps including more detailed diagnostics or broader card type support beyond what the basic Credit Card Checker provides.

Another related tool is “BINfinder and Credit Card Generator.” This application steps into a slightly different domain by offering a BIN (Bank Identification Number) finder and an international credit card number generator. While the generator aspect is typically for development, testing, or educational purposes (not for creating real, usable credit cards), the BIN finder can provide valuable information about the issuing institution of a credit card. This tool targets a more technical user or developer who needs to understand the structure and origin of card numbers, a more specialized function compared to simple validity checking.

Lastly, “Credit Card Tracking” focuses on financial management, helping users “keep track of your credit card expenses.” This tool moves beyond mere validation into the realm of personal finance management, providing a way to monitor spending. Such an application is invaluable for budgeting and financial oversight, a distinctly different purpose from checking card validity.

In comparison, Blueice’s Credit Card Checker remains focused on its core, simple task: validating a credit card number. This singular focus likely contributes to its lightweight nature and ease of use. It doesn’t aim to generate numbers or track expenses; its goal is solely to provide a quick verification, making it ideal for users who need that specific utility without the added complexity or cost of more comprehensive solutions. It fits the niche of a quick, free, and no-frills checker, which is precisely what many users seek.

Technical Specifications and PhanMemFree’s Assurance

Understanding the technical details of any software is crucial for informed users, and PhanMemFree provides transparent specifications for the Credit Card Checker, alongside a critical assessment of its security status.

Detailed Application Specifications

The Credit Card Checker comes with a clear set of specifications:

- License: Free – reinforcing its accessibility without financial barriers.

- Version: 1.3 – the latest iteration of the software.

- Latest update: September 30, 2021 (though previously mentioned as June 17, 2012, indicating a potential re-listing or catalog update date vs. actual software update). This discrepancy might imply the listing on PhanMemFree was updated, or the last official check of the software’s status. For a precise overview, the June 2012 date for the actual software update seems more consistent with the given version number.

- Platform: Windows – confirming its exclusive compatibility.

- OS: Windows 95 – further emphasizing its broad, legacy compatibility.

- Language: English – indicating its primary linguistic interface.

- Downloads: 8K (last month’s downloads: 6) – reflecting its recent activity on PhanMemFree.

- Size: 575.95 KB – confirming its status as a remarkably lightweight application.

- Developer: Blueice – crediting the creator of the software.

These specifications collectively paint a picture of a small, focused utility that has maintained a consistent presence over time. Its minute size is particularly noteworthy, highlighting its efficiency and minimal impact on system resources, which is a significant factor for users concerned about system performance or limited storage.

PhanMemFree’s Security Status and Commitment

A critical aspect of downloading software from any platform is the assurance of its safety. PhanMemFree takes this responsibility seriously, employing rigorous security protocols to protect its users. For the Credit Card Checker, PhanMemFree has assigned a “Clean” security status, which is a testament to its safety.

PhanMemFree’s process involves scanning all files hosted on its platform to identify and mitigate any potential harm to users’ devices. This comprehensive approach includes checks each time a new file is uploaded and periodic reviews to update or confirm their status. The “Clean” status means that PhanMemFree’s team has scanned the file and all associated URLs with over 50 of the world’s leading antivirus services, and no possible threat has been detected.

This meticulous verification process is fundamental to PhanMemFree’s commitment to providing a malware-free catalog of programs and apps. They acknowledge the possibility of “false positives,” where benign programs are mistakenly flagged as malicious due to overly broad detection signatures. However, their multi-layered scanning ensures that such instances are minimized, and users are provided with the most accurate security assessment possible. In the rare event that a potentially malicious program is missed, PhanMemFree encourages user feedback through its “Report Software” feature, integrating community vigilance into its security framework. This dedication to user safety is a cornerstone of PhanMemFree.org’s operational philosophy, instilling confidence in users who rely on its platform for software downloads.

The Broader Context: Why Credit Card Verification Matters

The utility of a Credit Card Checker extends far beyond a simple programmatic function; it touches upon critical aspects of digital commerce, fraud prevention, and responsible financial practices. In an increasingly digital world, the ability to quickly and accurately verify credit card details is indispensable.

For individuals, a credit card checker can be a valuable tool for personal financial hygiene. While consumers typically don’t verify their own cards against a database, a checker might be used in specific scenarios: perhaps to confirm a number after manually transcribing it, to validate dummy card numbers for software testing, or simply for educational purposes to understand card structures. More critically, for small businesses, online merchants, or service providers who handle card-not-present transactions, the ability to perform an initial validity check can be a rudimentary line of defense against erroneous entries or even some forms of fraud. Although a basic checker cannot prevent sophisticated fraud (which requires advanced anti-fraud systems, address verification services, CVV checks, and 3D Secure protocols), it can flag invalid card numbers at the point of entry, saving time and potential processing fees for failed transactions.

Fraud prevention is a monumental challenge in the digital age, costing businesses and consumers billions annually. While a Credit Card Checker is a rudimentary tool in this fight, it embodies the first step in validation. The primary method often employed by such checkers involves the Luhn algorithm (mod 10 algorithm), a simple checksum formula used to validate a variety of identification numbers, including credit card numbers. This algorithm can quickly determine if a sequence of digits could be a valid credit card number, even if it doesn’t confirm the existence of an active account. By identifying numbers that fail this basic check, businesses can immediately reject transactions, thereby minimizing chargebacks and financial losses. For developers, these tools are invaluable for testing payment gateways and e-commerce platforms, ensuring their systems correctly handle valid and invalid card inputs.

Moreover, the prevalence of such free tools contributes to a broader understanding of financial security. By making validation accessible, it demystifies some aspects of credit card processing and encourages a more informed approach to digital transactions. It serves as a reminder that not all sequences of numbers are valid, and a basic check can prevent simple errors.

Enhancing Productivity with Specialized Tools

The Credit Card Checker is categorized as “Productivity software,” a classification that speaks volumes about its role in streamlining tasks and improving efficiency. In the modern workflow, whether personal or professional, specialized tools like this are vital for optimizing processes that might otherwise be cumbersome or prone to error.

Productivity software encompasses a wide array of applications designed to help users perform tasks more efficiently and effectively. This can range from word processors and spreadsheets to project management tools and, as in this case, specific utilities for data validation. For anyone routinely handling credit card numbers, a manual verification process is not only time-consuming but also susceptible to human error. A dedicated Credit Card Checker automates this process, providing instant feedback and significantly reducing the effort required. This automation is the hallmark of good productivity software – it takes a repetitive or complex task and simplifies it, freeing up user time and cognitive load for more critical activities.

Consider a small online store owner or a freelance developer: they might not have access to sophisticated enterprise-level payment processing systems that handle all validation automatically. In such scenarios, a free, lightweight tool that can quickly check the format validity of a credit card number before further processing can be a lifesaver. It helps in basic data entry validation, reduces the frustration of failed transactions due to incorrect numbers, and ensures that preliminary checks are performed without needing to integrate complex APIs or services. This efficiency translates directly into saved time, reduced operational costs, and an overall smoother workflow. The Credit Card Checker, therefore, serves as a testament to how even seemingly simple utilities can profoundly impact individual and business productivity by addressing a specific, recurring need with a focused solution.

User Experience and Community Feedback

A key component of any software’s lifecycle is user feedback, which guides improvements and provides insights into real-world performance. In the case of the Credit Card Checker, PhanMemFree provides a platform for this community engagement.

As of the available data, the section for user reviews on PhanMemFree for the Credit Card Checker indicates, “Have you tried Credit Card Checker? Be the first to leave your opinion!” This suggests that, despite its significant download count and sustained popularity, there might not be a large volume of public reviews published on the PhanMemFree platform itself. This isn’t uncommon for utility software that performs a simple, specific task; users often download, use, and if it works as expected, move on without necessarily leaving a review. The absence of negative reviews is, in itself, a form of positive feedback, implying that the software performs its core function without significant issues that would prompt users to complain.

Encouraging users to “Rate it!” directly on the product page is a mechanism PhanMemFree uses to build a robust feedback loop. User opinions, even if just a star rating, contribute to the software’s overall reputation and help prospective users make informed decisions. For a free productivity tool like the Credit Card Checker, positive ratings and reviews could highlight its reliability, ease of use, or the specific scenarios where it proved most useful. Conversely, constructive criticism could help the developer, Blueice, understand potential areas for improvement, should they decide to update the application. The continuous availability of a review mechanism ensures that, at any point, users can contribute their experiences, fostering a sense of community around the software catalog provided by PhanMemFree.org.

Conclusion: A Reliable Aid in Digital Finance

The Credit Card Checker by Blueice stands out as a functional, free, and lightweight productivity tool tailored for Windows users. Its core mission is straightforward yet critical: to validate credit card numbers. In an increasingly digital economy where transactions are omnipresent, having such a utility provides a foundational layer of security and efficiency, whether for personal organization, educational purposes, or preliminary checks in business environments.

Since its inclusion in the PhanMemFree catalog in 2012, the software has demonstrated sustained popularity, amassing tens of thousands of downloads across various countries. This global reach underscores a universal demand for simple, reliable financial verification tools. Its minimal system requirements and small file size make it an accessible option for a wide range of Windows operating systems, including older versions, ensuring that performance is not compromised.

While the competitive landscape includes more advanced or specialized alternatives, the Credit Card Checker maintains its niche by focusing on its primary function without added complexity or cost. This singular focus, combined with PhanMemFree’s rigorous security screening and “Clean” status, offers users peace of mind regarding the software’s integrity.

In essence, the Credit Card Checker serves as a practical example of how targeted productivity software can simplify essential tasks, contribute to basic fraud prevention, and enhance overall digital security. Its enduring presence and consistent utility affirm its value as a dependable resource for anyone needing a quick and free way to ensure transactional integrity in the digital realm. As digital finance continues to evolve, tools like the Credit Card Checker, supported by platforms committed to safety and accessibility like PhanMemFree.org, remain indispensable components of our digital toolkit.

File Information

- License: “Free”

- Version: “1.3”

- Latest update: “September 30, 2021”

- Platform: “Windows”

- OS: “Windows 95”

- Language: “English”

- Downloads: “8K”

- Size: “575.95 KB”