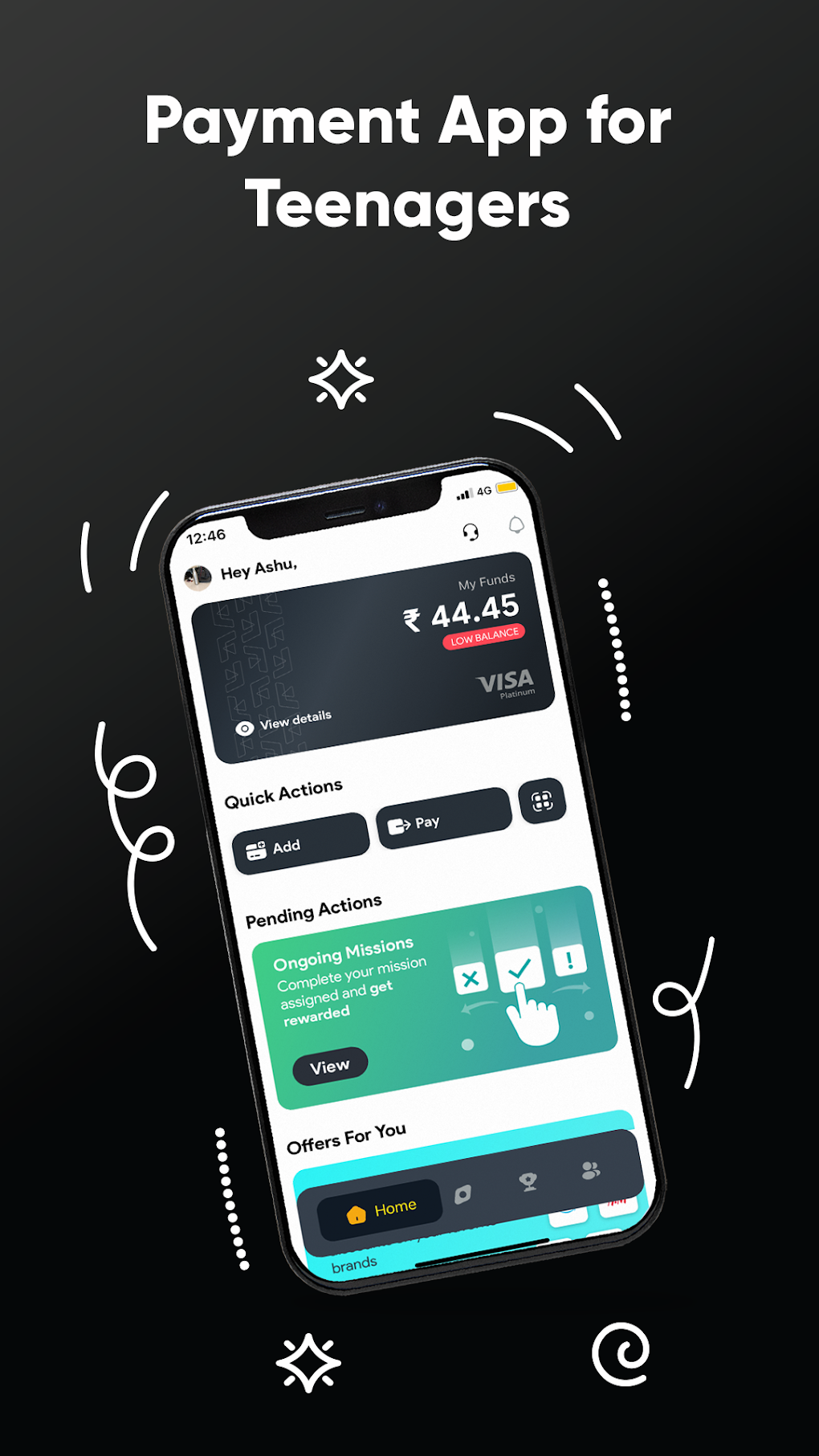

The financial landscape is evolving, and with it, the need for age-appropriate financial tools. For teenagers navigating the increasingly digital world of commerce, having access to a safe and user-friendly payment system is crucial. FYP Payment App for Teens provides just that – a secure platform designed specifically for young people to earn, manage, and spend money responsibly. This comprehensive review delves into the features, functionality, and overall value proposition of the FYP app, examining its strengths and addressing any potential concerns.

A Secure and Convenient Platform for Teenagers

FYP, developed by Fyp Money, isn’t just another payment app; it’s a financial ecosystem built with teenagers’ needs in mind. Recognizing the vulnerabilities and challenges faced by young people in managing their finances, the app prioritizes safety and ease of use. Developed in collaboration with YES Bank and the Visa Network, the app leverages the security infrastructure of established financial institutions, providing a robust shield against fraud and unauthorized access. This partnership ensures a level of protection rarely seen in apps specifically targeting a younger demographic.

The app’s core functionality revolves around the concept of “Mynt,” the app’s digital currency. Teens can earn Mynt through various avenues, creating a system that encourages financial responsibility and savvy spending habits. This digital currency can be redeemed for a range of rewards, transforming financial management from a chore into a potentially rewarding experience. This gamified approach to finance is a key differentiator, making the app more engaging and less daunting for young users.

One of the standout features of FYP is its numberless card. This innovative approach to payment security removes the risk associated with physical card theft or loss. The virtual card is linked to the app, providing the same functionality as a traditional debit card, but with significantly enhanced security features. The virtual nature of the card minimizes the risk of fraud, a critical concern for parents and guardians.

The app’s user interface is intuitive and easy to navigate, even for users with limited experience managing finances. The simple design avoids overwhelming young users with complex financial jargon, promoting financial literacy in an accessible and engaging manner. This user-friendly design is essential for attracting and retaining young users.

Beyond Payments: A Holistic Financial Ecosystem

FYP isn’t limited to simple online transactions; it encompasses a broader range of financial services, making it a comprehensive solution for teenagers’ financial needs. The app allows teens to pay bills online, eliminating the need for physical checks or cash payments. This functionality integrates seamlessly with the digital currency system, further promoting the use of the app for daily financial tasks.

Furthermore, FYP offers offline transaction capabilities, bridging the gap between online and offline commerce. This dual functionality caters to diverse situations, ensuring that teenagers can use the app regardless of their location or access to internet connectivity. This feature highlights the app’s versatility and its ability to accommodate varied usage patterns.

The app also provides access to exclusive deals and cashback opportunities, introducing teenagers to smart spending habits and potential savings. This feature not only adds value for users but also educates them about responsible financial management and the benefits of comparing prices and making informed purchasing decisions.

The integration of recharge capabilities within the app allows users to conveniently top up their mobile phones or other devices, further consolidating their financial management within a single platform. The convenience of this integrated service enhances the app’s overall utility and appeal.

Parental Controls and Safety Features

Recognizing the importance of parental oversight, FYP incorporates features to ensure responsible usage. Although specifics regarding the extent of these controls are limited in the available information, the partnership with established financial institutions suggests a commitment to safeguarding young users’ financial security. This implicit commitment to parental control provides an additional layer of assurance for parents entrusting their children with the app.

The secure transactions facilitated by the collaboration with YES Bank and the Visa Network provide an added layer of security beyond basic parental controls. The robust security infrastructure of these financial giants enhances the overall safety of the app and reduces the risk of fraud and unauthorized transactions.

This commitment to security, combined with the app’s intuitive design, aims to empower young users to manage their finances responsibly while providing parents with the reassurance of a secure platform. This balanced approach fosters financial independence while maintaining a level of parental control.

Comparison with Other Teen-Focused Payment Apps

The market for teen-focused payment apps is growing, with several competitors offering similar features. While FYP stands out with its integration of digital currency, numberless card, and offline transaction capabilities, a direct comparison with other popular options provides further context.

Apps like FamPay, Akudo, and muvin offer features like UPI payments and virtual cards, but they may lack the comprehensive financial ecosystem provided by FYP. The inclusion of bill payment, recharge options, and exclusive deals differentiates FYP, positioning it as a more complete financial solution rather than just a simple payment tool.

The gamification of financial management through the Mynt system also distinguishes FYP from competitors, potentially enhancing its appeal and encouraging responsible financial behaviour among young users. The competitive landscape underscores the importance of understanding the specific needs and priorities of each app before making a choice.

The differences in features and functionalities highlight the need for careful consideration when choosing a payment app for teenagers. While many apps offer basic payment capabilities, FYP’s comprehensive approach and focus on safety and responsible financial habits set it apart.

Conclusion: Empowering Teens with Financial Responsibility

FYP Payment App for Teens offers a compelling blend of security, convenience, and features designed to empower young people with the tools necessary to manage their money effectively. The app’s innovative features, such as the Mynt digital currency and numberless card, address critical security concerns while providing a user-friendly experience. The comprehensive nature of the app, extending beyond simple payments to include bill payments, recharges, and exclusive deals, positions it as a valuable tool for teenagers navigating the complexities of modern finance.

While further information on specific parental control features would be beneficial, the app’s partnership with established financial institutions assures a high level of security. The app’s intuitive design and focus on financial literacy promote responsible spending habits, empowering young users to manage their finances responsibly. For parents seeking a safe and effective way for their teenagers to manage money, FYP deserves serious consideration. The app represents a significant step forward in providing teenagers with accessible and secure financial tools, shaping responsible financial habits from a young age.

File Information

- License: “Free”

- Version: “7.0.0”

- Latest update: “July 19, 2023”

- Platform: “Android”

- OS: “Android 13.0”

- Language: “English”

- Downloads: “65.1K”

- Download Options: “Google Play”