PayPal, a name synonymous with online payments, has become an integral part of the digital economy. This article provides a comprehensive overview of PayPal’s services, features, advantages, and disadvantages, exploring its impact on both consumers and businesses worldwide. From its beginnings as a pioneering online payment platform to its current status as a leading mobile money transfer application, PayPal’s evolution reflects the changing landscape of digital transactions.

PayPal’s Core Functionality: Sending, Receiving, and Secure Transactions

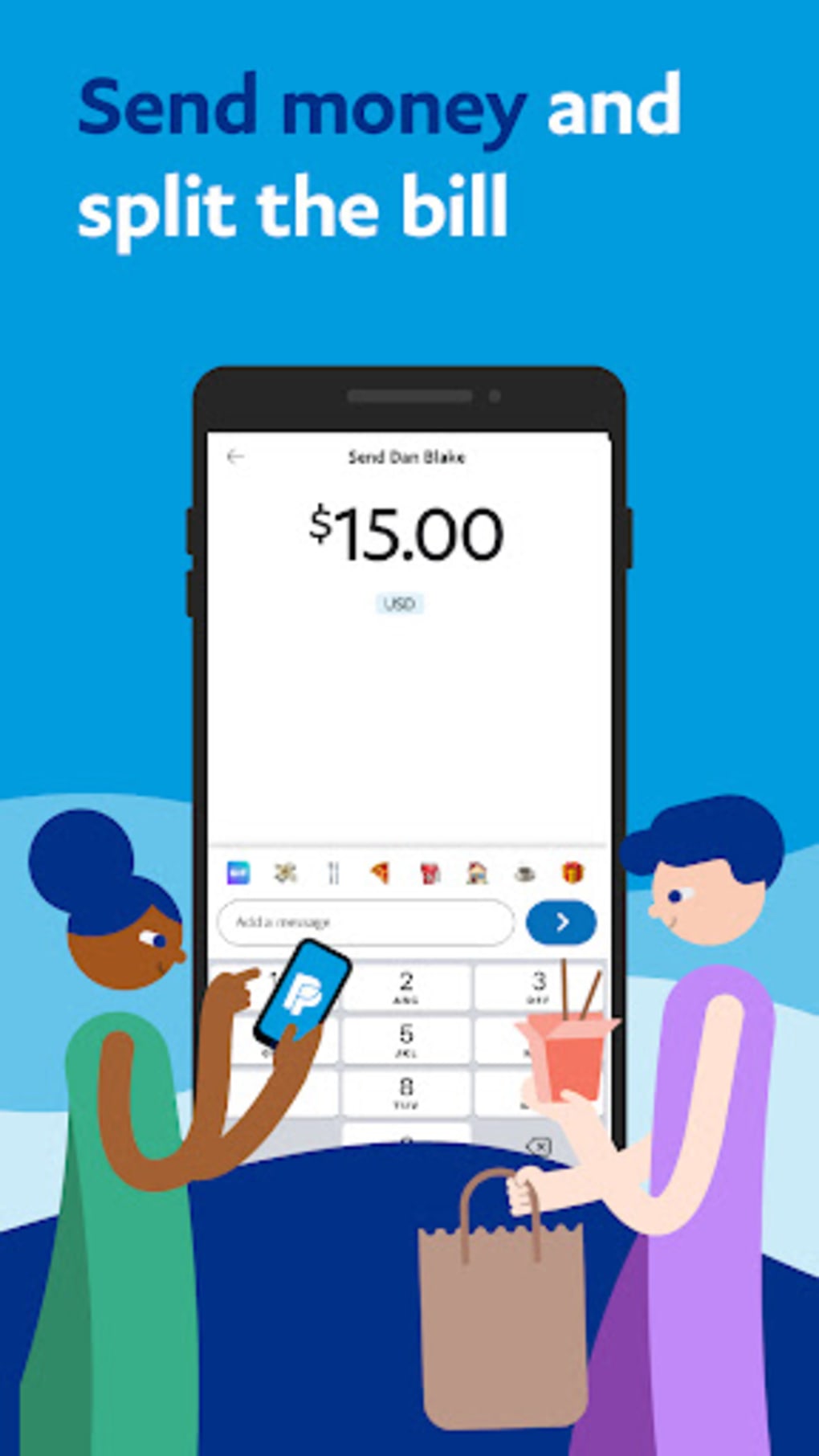

At its core, PayPal facilitates the secure transfer of funds between individuals and businesses globally. Users can send and receive money from other PayPal users, making it ideal for peer-to-peer transactions, online shopping, and business-to-consumer payments. This functionality extends beyond simple transfers; PayPal integrates with various online marketplaces and platforms, enabling seamless purchasing experiences for millions of users worldwide. The platform supports a wide range of currencies, simplifying international transactions and eliminating the complexities often associated with cross-border payments. This accessibility is a key driver of PayPal’s global reach and popularity.

Beyond peer-to-peer transfers, PayPal provides robust support for businesses of all sizes. Businesses can use PayPal to receive payments for goods and services, manage invoices, and track transactions efficiently. The integration of PayPal with various e-commerce platforms and shopping carts streamlines the checkout process, leading to increased customer satisfaction and improved sales conversion rates. PayPal also offers tools for businesses to manage their finances, including reporting, reconciliation, and dispute resolution mechanisms.

The platform’s emphasis on security is a crucial aspect of its success. PayPal employs advanced encryption techniques and fraud prevention measures to protect users’ financial information and transactions from unauthorized access and malicious activities. Multi-factor authentication, two-stage encryption, and robust account monitoring systems enhance security, fostering trust and confidence among users. PayPal’s commitment to security ensures a safe and reliable environment for online financial transactions.

Setting Up and Using a PayPal Account: A Step-by-Step Guide

Creating a PayPal account is a straightforward process. Users begin by providing basic information, including their email address, phone number, and a chosen password. Two security questions are then set up as an added layer of protection for account access. While account creation is free, linking a bank account or credit/debit card is essential for transferring money to and from the PayPal account.

While opening an account incurs no fees, transaction costs vary. These fees are contingent upon several factors: the location of the transaction, the currency involved, and the transaction amount itself. PayPal differentiates between “personal transactions,” which are typically transfers between family and friends, and “commercial transactions,” encompassing payments for goods, services, or charitable donations. The fees associated with commercial transactions are generally higher than those for personal transfers.

The application itself is user-friendly, allowing for easy navigation and access to key functions. Users can effortlessly check their transaction history, transfer funds to bank accounts or other e-wallets, and access their balance statements anytime. The app’s interface is intuitive, making it suitable for users of varying technical proficiency levels.

PayPal’s Advantages and Disadvantages: A Balanced Perspective

PayPal’s widespread adoption is attributed to several key advantages. The platform’s acceptance by a vast network of online merchants simplifies online shopping, making it a preferred payment option for many consumers. The ability to transfer money to most local and international banks provides flexibility and convenience for users. Real-time transaction updates for verified users enhance transparency and facilitate efficient money management. Furthermore, PayPal’s robust security measures provide users with peace of mind when conducting online financial transactions.

However, PayPal’s higher transaction fees compared to some competitors can be a drawback for frequent users. The wait times for initial transactions for new users can also be frustrating, although these verifications are part of the platform’s security protocols designed to prevent fraudulent activities.

Despite these minor inconveniences, PayPal’s vast network of connected banks and accepted credit cards remains a significant advantage, especially for international transactions. The platform’s accessibility extends to a wide range of devices and operating systems, ensuring user convenience regardless of their technological preferences. This accessibility factor, combined with the security measures, makes PayPal a compelling choice for many users.

PayPal’s Ongoing Evolution: Adapting to the Digital Landscape

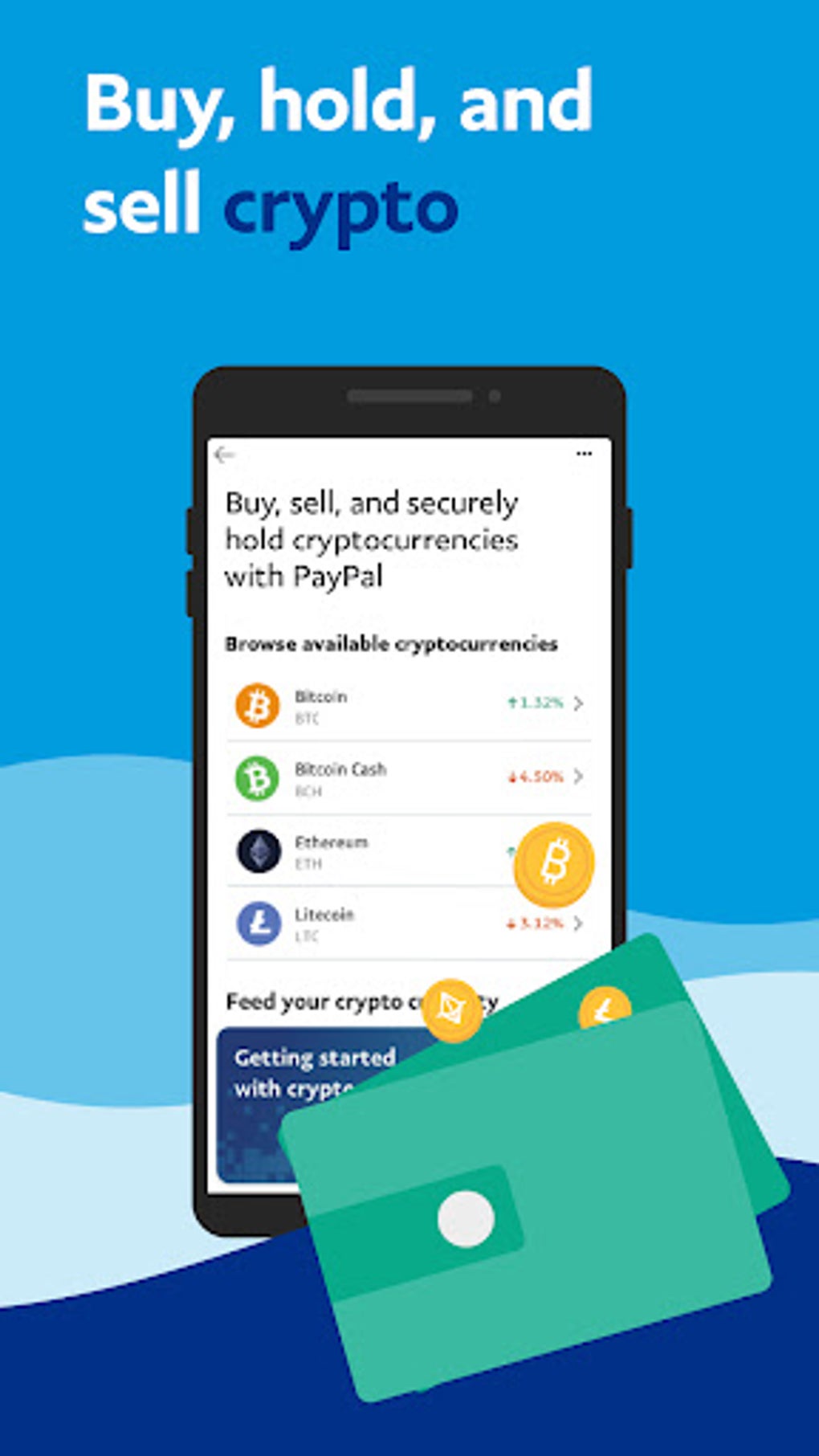

PayPal continuously evolves to meet the changing needs of the digital marketplace. It incorporates new features, enhances security measures, and expands its functionality to stay competitive. The integration of cryptocurrency support reflects its responsiveness to emerging technologies and its effort to cater to the evolving preferences of its user base. These adaptive measures contribute to PayPal’s ongoing relevance and leadership position in the online payment industry.

The platform also invests significantly in customer support, providing various channels for users to seek assistance and resolve any issues they may encounter. This commitment to customer service is a vital aspect of PayPal’s success, ensuring a positive user experience and fostering customer loyalty.

Conclusion: PayPal’s Enduring Legacy in Online Payments

PayPal’s enduring success stems from its commitment to security, convenience, and widespread accessibility. While competitors have emerged with lower fees, PayPal’s combination of global reach, robust security features, and widespread merchant acceptance solidifies its position as a leading player in the online payment arena. The platform’s continued evolution and adaptation to the changing digital landscape ensures its continued relevance and impact on the global financial ecosystem. For many users, the peace of mind offered by PayPal’s security measures outweighs the slightly higher transaction fees, making it a preferred choice for a wide spectrum of online financial transactions.

File Information

- License: “Free”

- Latest update: “February 5, 2025”

- Platform: “Android”

- OS: “Android 13.0”

- Language: “English”

- Downloads: “431.9K”

- Download Options: “Google Play”