Cash App, originally launched as Square Cash, has revolutionized the landscape of digital transactions. Developed by Square Inc., this mobile application provides a convenient and secure platform for managing personal finances from virtually any device. Its seamless integration of various financial services has propelled Cash App to the forefront of digital payment apps, rivaling established players like PayPal and Venmo. This comprehensive guide will explore the multifaceted features of Cash App, its functionality, limitations, security measures, and alternatives.

Sending and Receiving Money: The Core Functionality

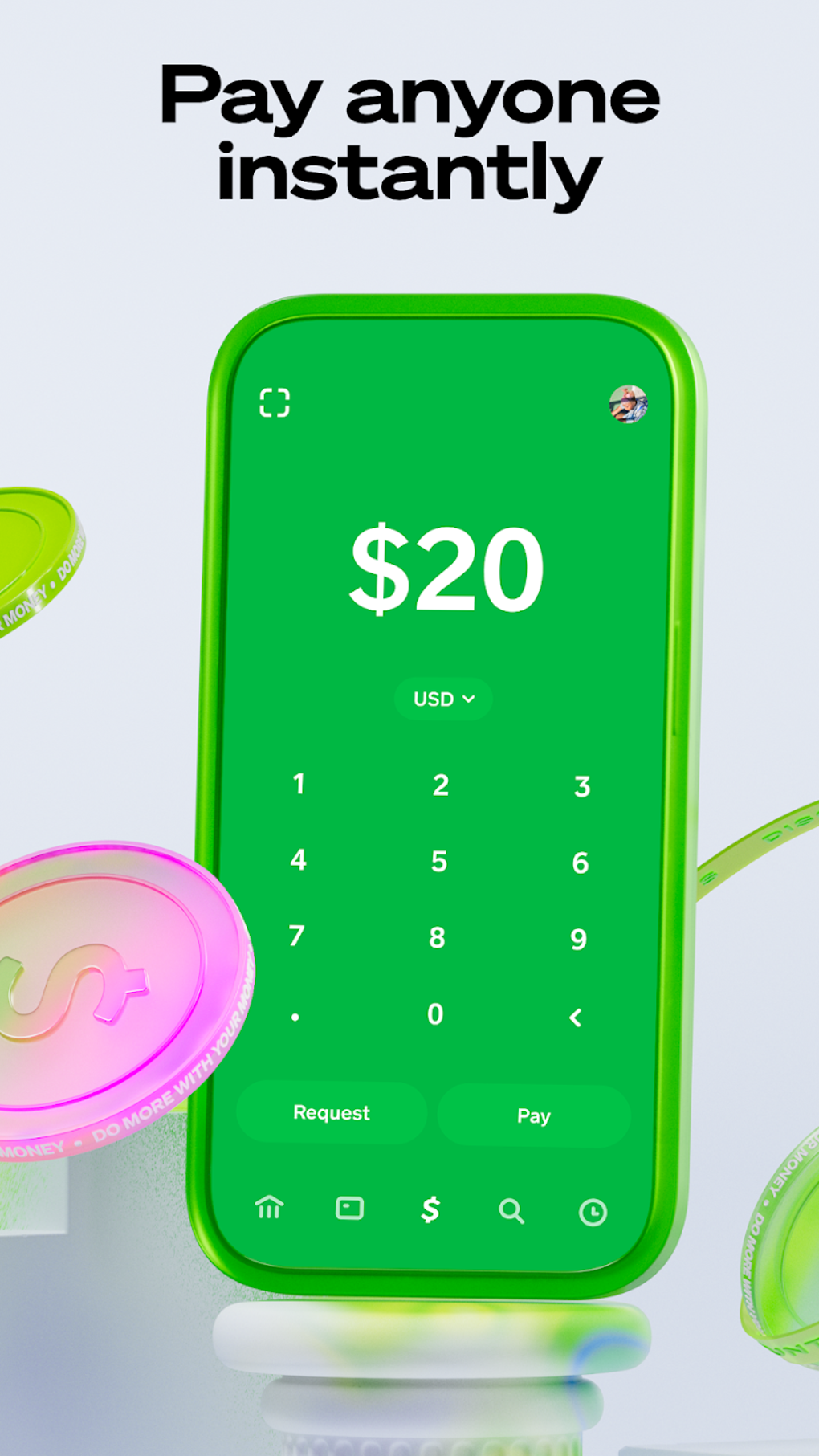

At its heart, Cash App is a peer-to-peer (P2P) payment system enabling users to quickly and easily transfer funds to friends, family, acquaintances, and businesses. The simplicity of the process has contributed significantly to its widespread adoption since its inception in 2013. Sending money involves inputting the recipient’s details – whether it’s their phone number, email address, or Cashtag (a unique username) – specifying the desired amount, adding an optional personal message, and confirming the transaction using a personal PIN. Receiving money is even simpler, with funds typically deposited instantly into the user’s Cash App balance. This streamlined approach makes Cash App an appealing alternative to traditional banking methods for everyday transactions.

Beyond Payments: Investing and More

Cash App’s functionality extends far beyond basic money transfers. It offers a range of investment opportunities, making it a one-stop shop for diverse financial needs. Users can buy, sell, and hold Bitcoin (BTC), although it’s crucial to acknowledge that Cash App’s fees for Bitcoin transactions can be relatively high compared to other specialized cryptocurrency platforms. Furthermore, while offering Bitcoin access is a significant feature, Cash App’s security measures for cryptocurrency may not be as robust as dedicated cryptocurrency wallets. Therefore, users should carefully weigh the risks and benefits before using this feature.

Another key feature is the ability to invest in stocks of various publicly traded companies. This feature democratizes stock market access, allowing individuals with limited financial experience to participate in investing. The app also integrates a Visa debit card, known as the Cash Card, facilitating both online and in-person purchases. This card adds a layer of physical accessibility to the digital platform, enhancing the overall convenience. Cash App further enhances user engagement through its “Boosts” program, offering discounts and promotions at participating merchants. This rewards system incentivizes app usage and provides tangible benefits to users.

Fees, Limits, and Account Verification

While many of Cash App’s core functions are free, certain activities incur fees. Standard transfers between users are generally free, but instant transfers involve a small fee. Stock investments are commission-free, but Bitcoin transactions involve both buying and selling fees. Using the Cash Card is largely free, with no fees for ATM withdrawals and Mastercard transactions, though some exceptions may apply depending on the ATM or merchant.

Cash App imposes limits on the amount of money users can send, receive, and hold within their accounts. These limits are directly tied to account verification. An unverified account has significantly lower transaction limits than a verified one. Verification involves providing personal information, including full legal name, date of birth, and the last four digits of the Social Security number (for US users).

-

Unverified Account Limits:

- Sending and receiving: $250 per week, $1,000 per 30 days

- Balance: $1,000

- Individual transaction: $2,500

- ATM withdrawal: $1,000 per day

- Bitcoin purchase: $10,000 per day

-

Verified Account Limits:

- Sending and receiving: $7,500 per week, $17,500 per 30 days

- Balance: No limit

Reaching these limits temporarily restricts further transactions until the next 7- or 30-day period begins. Account verification offers a straightforward solution to increase these limits immediately.

International Transactions and Limitations

Cash App’s international functionality is limited. While users can transact with individuals within the US and UK, it does not support cross-border transactions with other countries. This means sending or receiving money internationally requires utilizing alternative money transfer services. Several reputable options exist, offering varying fees and transfer speeds. These include:

- Wise (formerly TransferWise): Known for competitive exchange rates and low fees.

- Remitly: A convenient service for fast international transfers with various payout options.

- PayPal: A widely used platform for online payments and international money transfers.

- WorldRemit: Offers secure and fast international money transfers at competitive rates.

Security and Regulatory Compliance

Cash App employs security measures to protect user data and transactions. It is registered with relevant regulatory bodies, such as the FDIC (Federal Deposit Insurance Corporation) in the US, which insures user wallets up to $250,000 in the event of bank failure. The platform uses encryption to safeguard payment-related information, minimizing the risk of unauthorized access and misuse.

Cash App Borrow: Short-Term Loan Feature

Cash App has introduced a “Borrow” feature offering short-term loans to eligible users. This feature provides access to loans ranging from $20 to $200, repayable within four weeks. Eligibility depends on factors like age (18 or older), residency in a supported state, and an activated Cash Card. The app considers user history and creditworthiness, favoring frequent and reliable users. Late payments incur a 1.25% weekly fee until the loan is repaid. Users can choose repayment methods, including automatic payments, manual payments, or mailing a check. While convenient, users should carefully review the terms and conditions before utilizing this feature.

Conclusion: Cash App as a Modern Banking Alternative

Cash App transcends the limitations of a simple P2P payment app. Its combination of features, including peer-to-peer transfers, cryptocurrency trading, stock investment options, and a debit card, makes it a comprehensive financial management tool. While it presents several advantages over traditional banking, users should be aware of its limitations, particularly regarding international transactions and higher fees associated with Bitcoin trading. The app’s overall convenience, user-friendly interface, and additional features like “Boosts” and the “Borrow” feature position it as a strong contender in the evolving landscape of digital finance. However, users should always prioritize thorough research and understanding of its terms and conditions before utilizing any of its services.

File Information

- License: “Free”

- Latest update: “November 19, 2024”

- Platform: “Android”

- OS: “Android 13.0”

- Language: “English”

- Downloads: “655.5K”

- Download Options: “Google Play”