Thinkorswim, developed by TD Ameritrade, is a powerful and customizable trading platform available for desktop and mobile devices. It provides a wide array of sophisticated tools designed for both novice and experienced traders, offering a comprehensive suite for analyzing markets, testing strategies, and executing trades. This review delves into the platform’s strengths and weaknesses, examining its features, usability, and potential drawbacks to help you determine if it’s the right fit for your trading needs.

Powerful Trading Tools and Features

Thinkorswim distinguishes itself through its extensive collection of advanced tools and features, catering to a broad range of trading styles and complexities. The platform’s core strength lies in its ability to facilitate in-depth market analysis and the thorough testing of trading strategies before deploying them with real capital. This is crucial for minimizing risk and maximizing potential returns.

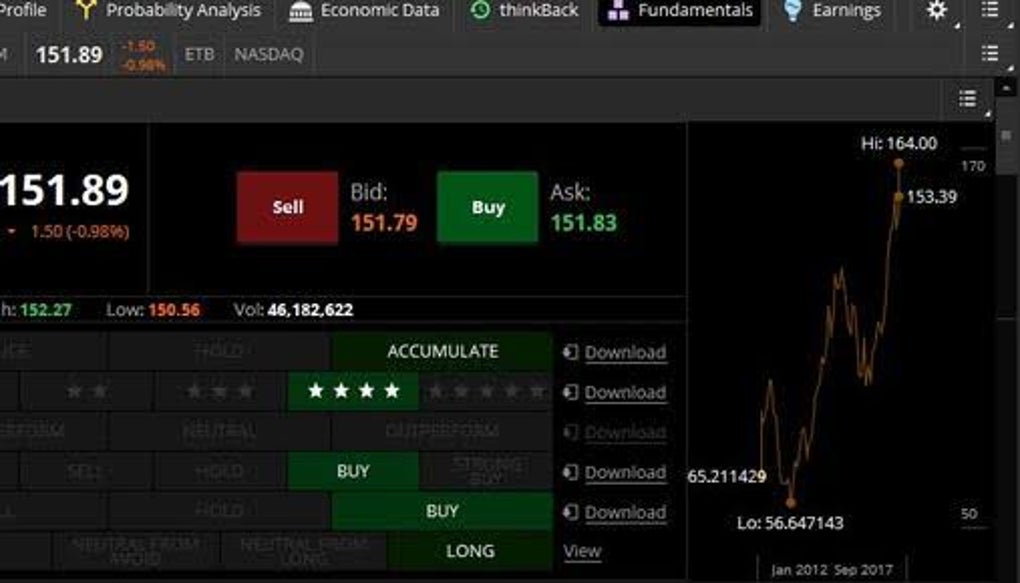

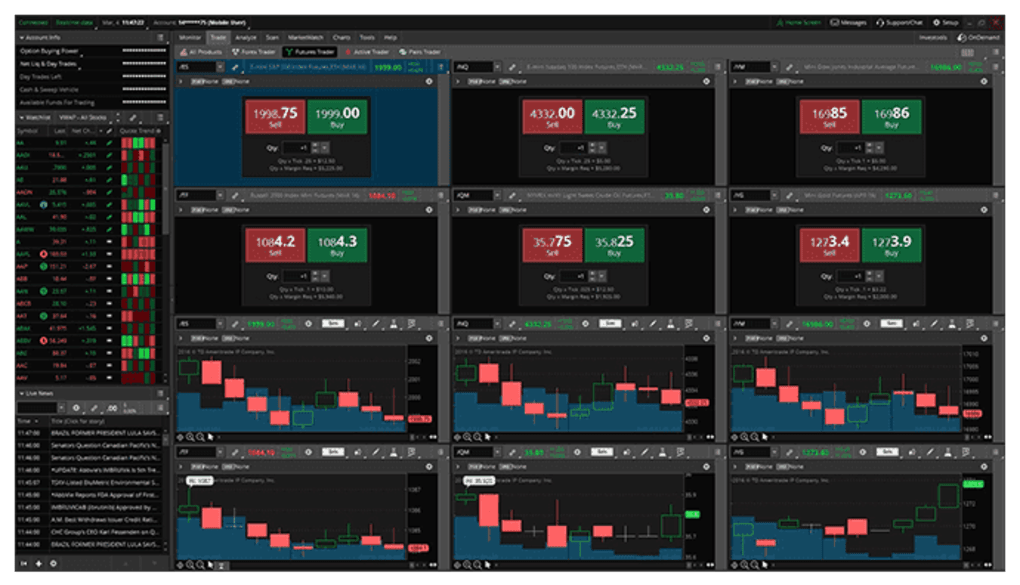

One of the key features is its robust charting capabilities. Traders can access a wide variety of charting styles, indicators, and drawing tools to visualize price movements, identify trends, and pinpoint potential entry and exit points. The platform supports multiple timeframes, allowing users to analyze markets from short-term scalping to long-term investment perspectives. This flexibility is vital for adapting to diverse market conditions and personal trading strategies.

Beyond charting, Thinkorswim offers a comprehensive suite of analytical tools. These include advanced technical indicators, fundamental data integration, and options analysis tools. Traders can easily access real-time market data, news feeds, and economic calendars, enabling them to stay informed about relevant market events and their potential impact on their positions. The platform’s ability to integrate various data sources provides a holistic view of the market, allowing for more informed decision-making.

The platform also incorporates backtesting capabilities, allowing traders to simulate the performance of their strategies using historical data. This feature is invaluable for refining trading strategies, identifying potential weaknesses, and evaluating their effectiveness before risking real money. Backtesting provides a controlled environment to experiment with different parameters and optimize trading systems for optimal performance.

.jpg)

Furthermore, Thinkorswim provides access to a dedicated trade desk, offering personalized support and guidance to users. This is particularly beneficial for those new to the platform or those needing assistance with complex trading strategies. The trade desk’s expertise can be a significant advantage, especially for navigating the platform’s more advanced features.

PaperMoney: Risk-Free Trading Practice

A standout feature of Thinkorswim is its integrated paperMoney account. This allows users to practice trading with virtual funds, replicating real market conditions without risking actual capital. The paperMoney account comes pre-loaded with $100,000 in virtual money, enabling traders to experiment with different strategies, test their risk management techniques, and gain confidence before committing real funds.

This risk-free practice environment is particularly valuable for beginner traders. It allows them to familiarize themselves with the platform’s features, learn about different trading instruments, and develop a solid understanding of market dynamics without financial consequences. Even experienced traders can benefit from paperMoney, using it to test new strategies or refine existing ones in a safe and controlled environment.

Beyond the virtual account, Thinkorswim also offers one-on-one demo sessions with members of their trade desk team. These 30-minute sessions provide a personalized walkthrough of the platform’s features and functionalities. This personalized guidance can significantly reduce the learning curve associated with the platform’s complexities.

Advanced Features and Insights

.jpg)

Thinkorswim extends beyond basic trading functionalities, incorporating several advanced features designed to enhance trading performance and provide insightful market analysis.

The Market Maker Move (MMM) tool is a prime example. This tool analyzes market volatility and predicts the potential magnitude of price movements. This predictive capability can help traders identify stocks with high potential for significant price swings, allowing them to capitalize on substantial market movements.

The platform also offers a real-time market monitor, presenting a comprehensive overview of the market using interactive maps and graphics. This visual representation of market activity allows traders to quickly identify trends, spot potential opportunities, and gain a broader understanding of market dynamics. The market monitor also provides access to detailed information such as forex rates, industry conference calls, and earnings reports, further enhancing market awareness.

The platform’s 24/5 trading capability provides access to global markets around the clock, excluding weekends. This expanded trading window provides additional opportunities for traders to participate in various market sessions worldwide, potentially increasing trading frequency and the likelihood of profitable trades.

Potential Drawbacks and Limitations

Despite its impressive array of features, Thinkorswim is not without its limitations. One of the most significant drawbacks is the steep learning curve associated with the platform. The sheer number of features and tools can be overwhelming for new users, particularly those without prior experience with advanced trading platforms. Mastering the platform’s functionalities requires significant time and effort, potentially discouraging less tech-savvy individuals.

The platform’s resource-intensive nature is another potential drawback. Thinkorswim requires substantial computing power and a stable internet connection to function optimally. This can pose challenges for users with limited computing resources or unreliable internet access. The platform’s demanding specifications can limit its accessibility to a broader audience.

The extensive customization options, while a benefit for experienced traders, can also lead to analysis paralysis. Traders might spend excessive time tweaking settings and fine-tuning parameters, potentially delaying or hindering actual trade execution. The abundance of choices can sometimes be counterproductive, distracting from the core task of trading.

Alternatives to Thinkorswim

While Thinkorswim is a leading platform, several alternatives offer similar functionalities and cater to different trading needs.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular choices, known for their user-friendly interfaces, automated trading capabilities (Expert Advisors), and a wide range of technical indicators. They provide a balance between functionality and accessibility.

TradingView is a strong contender, focusing on robust charting tools and social trading features. Its emphasis on community interaction and shared trading ideas is attractive to traders who value collaborative learning and the exchange of perspectives.

E*TRADE provides a comprehensive trading platform with integrated research and educational resources, making it suitable for beginners and experienced traders alike. Its blend of user-friendliness and advanced features positions it as a balanced option.

Interactive Brokers (IBKR) caters to active traders and investors seeking a sophisticated platform with access to a wide variety of assets and low trading fees. Its advanced tools and breadth of offerings make it a preferred choice for professionals.

The choice of platform ultimately depends on individual trading styles, experience levels, and specific requirements.

Conclusion

Thinkorswim stands out as a robust and customizable trading platform, providing a comprehensive suite of tools for advanced market analysis and strategy testing. Its paperMoney feature allows risk-free practice, making it suitable for both novice and experienced traders. However, the platform’s steep learning curve, resource-intensive nature, and potential for analysis paralysis should be considered. Ultimately, Thinkorswim’s suitability depends on a trader’s specific needs and technical proficiency. Weighing its strengths against potential drawbacks is crucial before committing to this powerful yet demanding trading platform.

File Information

- License: “Free”

- Version: “1.0”

- Latest update: “June 24, 2024”

- Platform: “Windows”

- OS: “Windows 8”

- Language: “English”

- Downloads: “3K”

- Size: “54.39 MB”