Venmo, a free social payments app owned by PayPal, has rapidly become a popular method for peer-to-peer (P2P) money transfers in the United States. Its unique blend of ease of use, social features, and integration with other financial services has propelled it to the forefront of digital payment solutions. However, understanding its strengths and limitations is crucial before adopting it as your primary payment method. This article provides a comprehensive overview of Venmo, exploring its functionalities, advantages, drawbacks, and viable alternatives.

Understanding Venmo’s Core Functionality

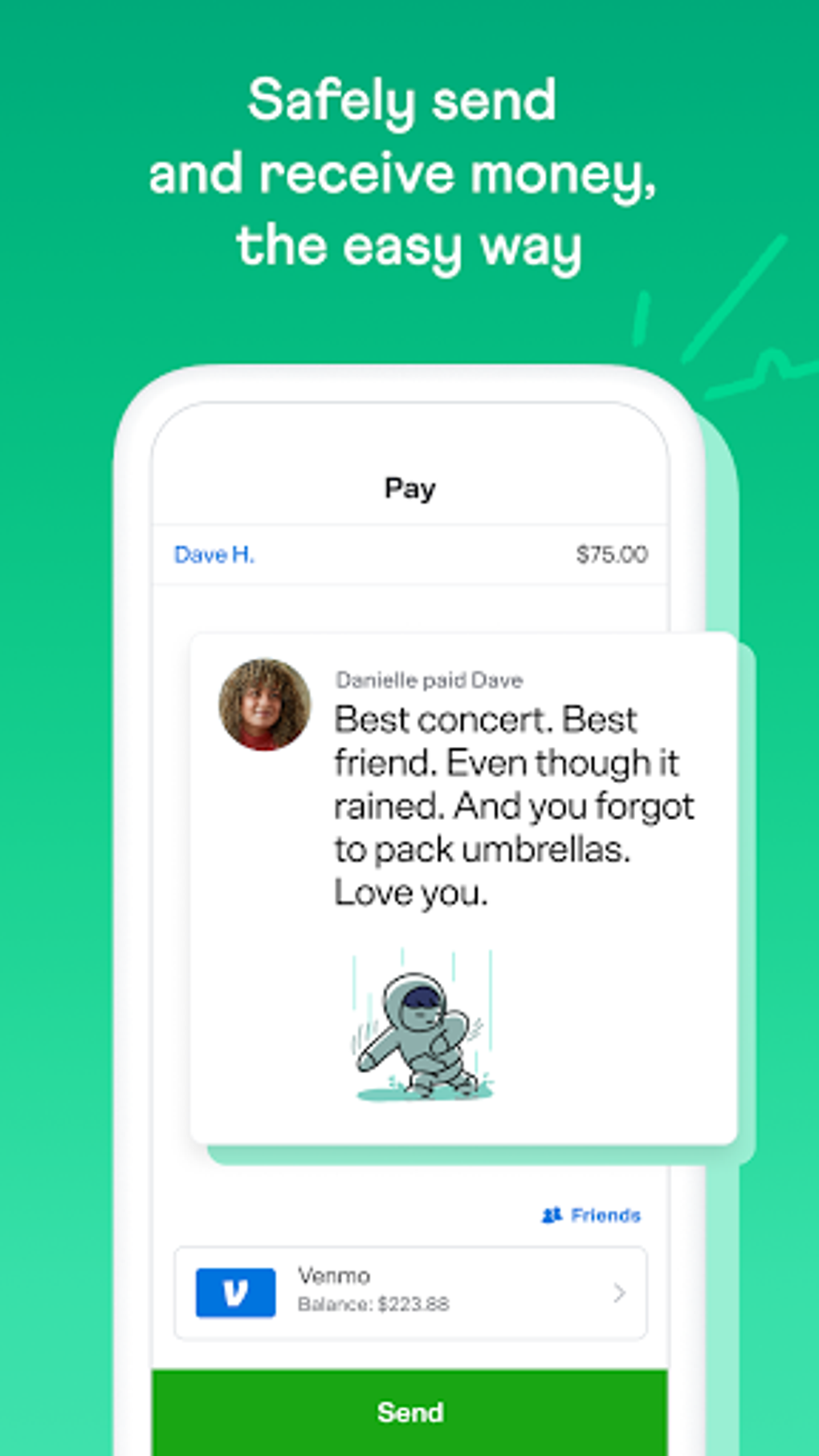

Venmo functions as a digital wallet and payment system, facilitating quick and effortless transactions. While currently limited to the U.S., it allows users to send and receive money through various methods, including direct transfers using phone numbers or email addresses, and QR code scanning for convenient payment exchanges. This seamless process allows users to easily settle debts, split bills, and transfer funds between friends and family.

One of Venmo’s most distinctive features is its social aspect. All public transactions, along with accompanying comments and emojis, are displayed on a user’s activity feed, creating a social media-like experience. This feature, while contributing to its popularity, also raises privacy concerns, which we will address later in the article. The amount of each transaction, however, remains hidden, protecting the specifics of individual payments.

Registering for Venmo is straightforward. Users can create an account using their phone number, email address, and personal information, or they can conveniently link their Facebook account for quicker registration. Once logged in, users can immediately start receiving and sending payments. The process is incredibly user-friendly: simply enter the recipient’s phone number or email address, input the amount, and confirm the transfer. If the recipient is not a registered Venmo user, they will be prompted to create an account to claim the funds. Transactions can be easily canceled before the recipient accepts, ensuring flexibility and control for the sender. The refunded amount will be returned to the sender’s Venmo balance or linked bank account, based on their preference.

Venmo’s Payment Methods and Integration

Venmo’s versatility extends to its payment options. Users can link their debit cards, bank accounts, or credit cards to their profiles. However, it’s important to note that credit card transfers to bank accounts are not directly supported. For credit card balances, users must first transfer funds to their Venmo balance and then withdraw them to their linked bank account or debit card.

When a payment is initiated, Venmo prioritizes using available funds in the user’s Venmo balance. If insufficient funds are present, the app automatically prompts the user to add money from a linked bank account or debit card to complete the transaction. This seamless integration simplifies the payment process, making it suitable for various scenarios, such as paying rent, settling bills with retailers, or managing shared expenses among friends.

Enhanced Security and Privacy Features

While Venmo’s social feed is a notable feature, it also represents a potential privacy concern for some users. By default, all transactions are publicly visible, although monetary amounts are hidden. However, users can easily adjust their privacy settings to make their transactions private, thus ensuring their financial details remain confidential.

Despite the public transaction feed, Venmo employs robust security measures to protect user data. Data encryption safeguards personal and financial information, adding a layer of protection against unauthorized access. The app also allows users to remotely log out of all devices from the Venmo website, a crucial feature in case of a lost or stolen device.

Recent Updates and Expanded Functionalities

Venmo continues to evolve, introducing updates that enhance user experience and expand its capabilities. One significant improvement is the integration of “Split Purchases” through PayPal. This enables users to divide the cost of purchases made via PayPal at checkout and subsequently settle the individual shares directly within the Venmo app. This function caters to the common practice of shared expenses among friends and family, enhancing convenience and streamlining the payment process.

Furthermore, Venmo has updated its business profile feature, providing small businesses with more sophisticated tools for managing payments and growth. Business accounts can now create more professional-looking profiles that clearly showcase their services and payment details, attracting customers and facilitating seamless transactions. This feature leverages the app’s social elements, helping businesses connect with their customer base directly through the platform.

Venmo’s commitment to enhancing security and transaction transparency is evident in its recent updates. Improved privacy settings give users more control over their data visibility, while detailed transaction histories increase transparency in how funds are managed. These improvements demonstrate Venmo’s dedication to adapting to evolving user needs and the demands of both personal and business users.

Venmo’s Integration with Cryptocurrency Platforms

Venmo’s integration with platforms like MoonPay allows eligible U.S. users to directly fund their MoonPay accounts using Venmo, facilitating easier access to cryptocurrency transactions. This partnership demonstrates Venmo’s strategic move towards integrating emerging financial technologies and broadening its services beyond traditional payments. By simplifying the transition from fiat currency to cryptocurrency, Venmo caters to the growing consumer interest in digital assets and enhances its position in the rapidly evolving digital payment landscape. This expansion reflects Venmo’s proactive approach to integrating emerging financial trends, positioning it as a leader in the innovative digital payment sector.

Limitations and Alternatives to Venmo

Despite its popularity and convenience, Venmo has limitations. Its primary restriction is its exclusive availability within the United States. International users are unable to utilize the app, making it unsuitable for cross-border transactions. While Venmo assures users of its commitment to security through data encryption and remote logout functionalities, the default public display of transactions (excluding amounts) might raise concerns for privacy-conscious users. Moreover, Venmo imposes fees on specific transactions, including instant transfers and credit card payments, which could deter users seeking strictly fee-free services.

Several alternatives offer similar functionalities with distinct advantages. Google Pay provides global payment capabilities, seamlessly integrating with Android devices and offering contactless payment options, ideal for in-person transactions. PayPal, Venmo’s parent company, remains a strong contender for international transactions, offering robust buyer and seller protection and broader global reach. Wise (formerly TransferWise) stands out for its low fees and competitive currency exchange rates, benefiting users performing cross-border payments. Cash App offers peer-to-peer payments alongside additional features such as investing and Bitcoin transactions, catering to a broader range of financial needs within a single app. The selection of alternative apps allows users to choose the platform that best aligns with their specific requirements, prioritizing factors like global reach, fee structures, or additional integrated financial tools.

Conclusion: A Versatile but Regionally Limited App

Venmo offers a compelling blend of ease of use, social integration, and evolving functionality for U.S. users. Its recent updates demonstrate a strong commitment to meeting users’ evolving needs, ensuring its continued relevance within the competitive digital payment landscape. The app’s user-friendly interface, coupled with its robust security measures, makes it a valuable tool for managing personal finances and social transactions. However, its current geographical limitations and associated fees should be considered when selecting a payment application. For U.S. residents seeking a convenient and socially integrated payment platform, Venmo certainly remains a strong contender. However, users outside the U.S. or those prioritizing international transactions or fee-free services should carefully evaluate the alternatives before making a choice.

File Information

- License: “Free”

- Version: “10.53.0”

- Latest update: “November 28, 2024”

- Platform: “Android”

- OS: “Android 12.0”

- Language: “English”

- Downloads: “101.3K”

- Download Options: “Google Play”