WavePay, developed by Wave Money, is a free mobile banking application designed for users in Myanmar. It functions as a mobile wallet, providing convenient access to a range of financial services directly from a smartphone. Similar to other popular mobile payment platforms like Paytm or PhonePe, WavePay streamlines online transactions, encompassing cash transfers, bill payments, and more. Its user-friendly interface and quick registration process, requiring only a mobile number for initial setup, contribute to its widespread adoption within the Myanmar market. This review delves into the features, benefits, drawbacks, and overall user experience of the WavePay app.

Ease of Use and Registration

One of WavePay’s significant strengths lies in its streamlined registration process. New users can quickly set up an account using only their mobile number, followed by a straightforward verification process. This eliminates the complexities often associated with traditional banking applications, making it accessible to a broader range of users, regardless of their technological proficiency. The intuitive interface further enhances user experience, allowing for effortless navigation and quick access to various features. The app’s clear design and straightforward layout make it easy to understand, even for first-time users of mobile banking applications.

.webp)

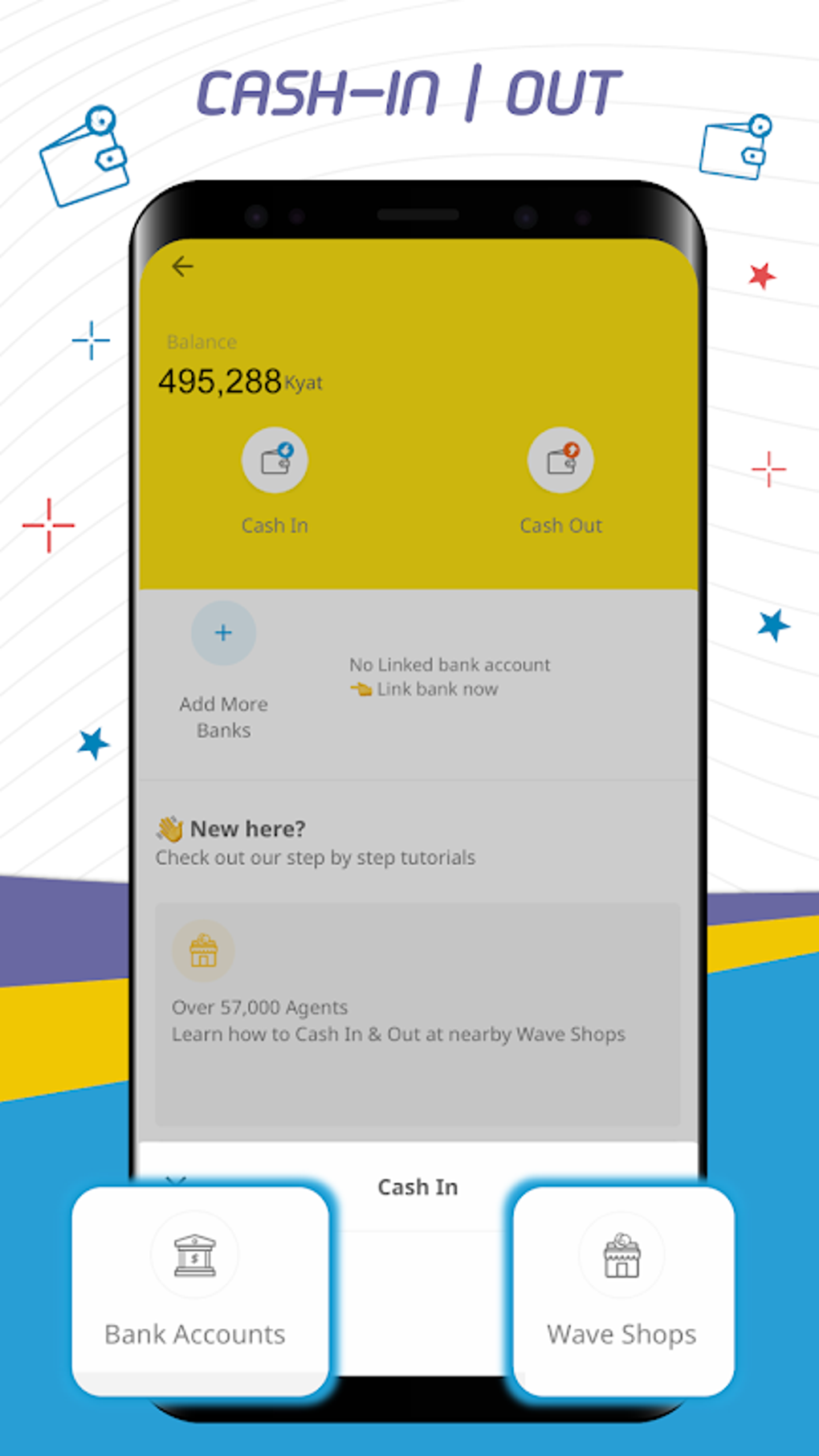

Comprehensive Financial Services

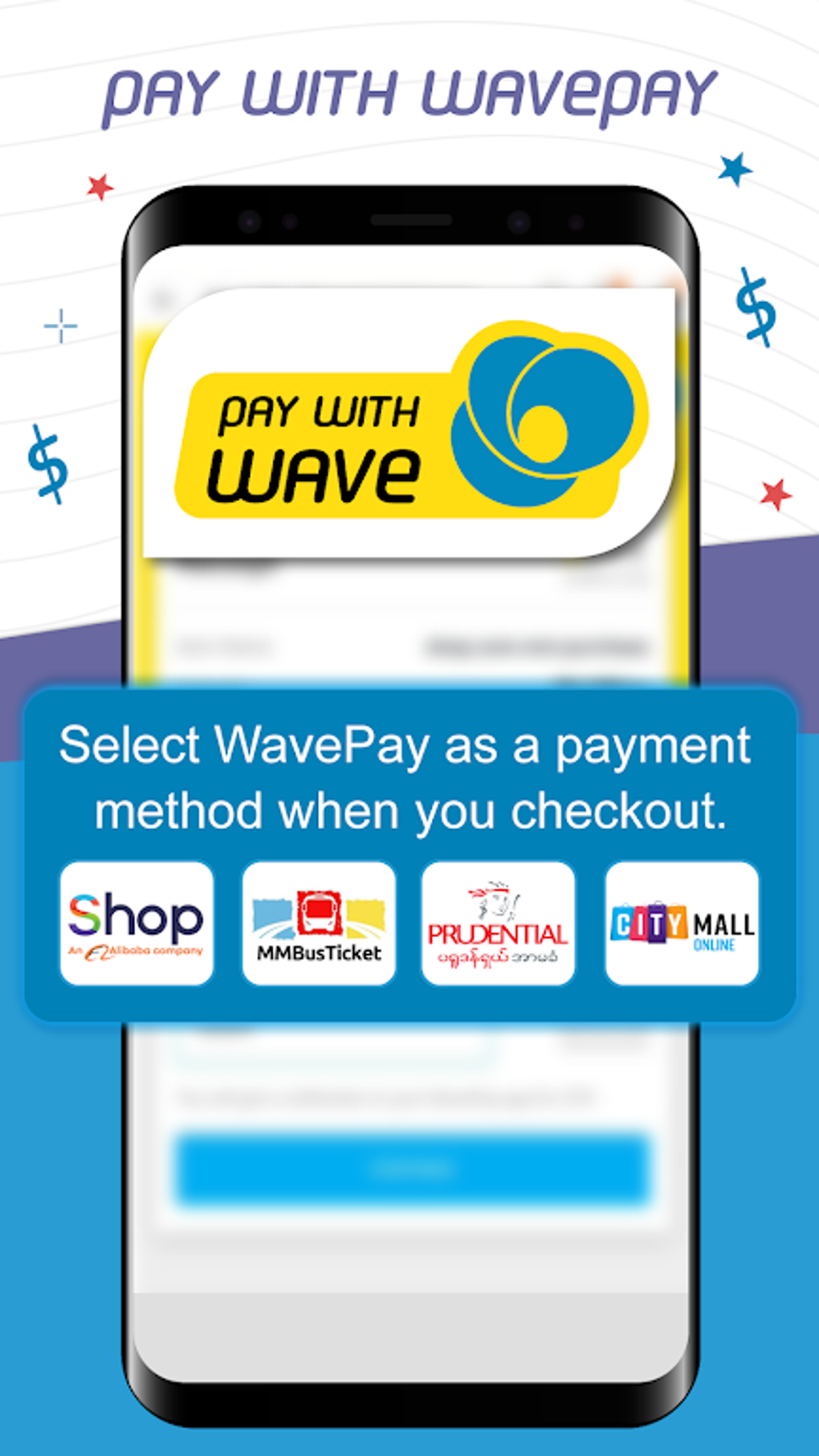

WavePay offers a wide array of financial services, catering to diverse user needs. Beyond basic transactions, users can perform cash-in and cash-out operations, easily top up mobile phone credit, and make purchases with multiple payment partners. This versatility makes it a one-stop solution for managing various financial aspects of daily life. The inclusion of microfinancing options provides additional support for users needing quick access to funds, further enhancing the app’s value proposition. The integration of diverse payment partners expands the range of services accessible through the application.

Security and Account Management

WavePay prioritizes user security with its “One Wallet, One Device” policy. This ensures that each account is securely linked to a single device, reducing the risk of unauthorized access and fraudulent activities. This feature contributes to the overall trustworthiness of the platform, instilling confidence in users regarding the security of their financial information. Furthermore, users can upgrade their account to Level 2, which unlocks additional perks and increases transaction limits. This tiered system allows users to tailor their access to services based on their individual needs and transaction volumes.

Limitations and Geographic Restrictions

While WavePay offers a comprehensive suite of features, it’s crucial to acknowledge its current limitations. The most significant constraint is its exclusive availability to users residing in Myanmar. This geographic restriction limits its accessibility to a specific market and prevents users from other regions from benefiting from its functionalities. This limitation is a key factor to consider when assessing the app’s overall usability and market reach. Future expansion to other countries could significantly enhance its global impact.

Comparison with Alternative Mobile Wallets

WavePay competes with other mobile wallet services available in Myanmar. KBZPay, another popular option, is often cited as a primary competitor. While both offer similar core functionalities, comparative analyses should be performed to determine which platform offers a better user experience, a more robust feature set, or superior security measures. Specific comparisons between WavePay and other mobile banking platforms available in Myanmar could reveal key differences in features, fees, transaction limits, and user interface designs.

User Reviews and Feedback

User reviews provide valuable insights into the overall satisfaction and experiences with WavePay. Analyzing user feedback can highlight both strengths and weaknesses of the application, offering valuable perspectives on areas requiring improvement. Positive reviews commonly praise the app’s ease of use, convenient functionalities, and reliable performance. Negative feedback may focus on areas such as occasional technical glitches, limited customer support, or specific feature requests. This feedback loop is vital for continuous improvement and enhancing the user experience.

Conclusion: A Valuable Tool for Myanmar Users

WavePay presents a valuable mobile banking solution for residents of Myanmar. Its user-friendly interface, comprehensive financial services, and strong security measures combine to create a convenient and reliable platform for managing finances. While the geographic limitation to Myanmar restricts its overall reach, it remains a compelling option within its target market. The app’s ongoing development and responsiveness to user feedback indicate a commitment to continuous improvement and enhancing user experience. Future updates could incorporate additional features, expand payment partner integrations, and potentially address some of the limitations currently present. The app’s overall success hinges on its ability to adapt to the evolving needs of its user base within Myanmar.

.webp)

Frequently Asked Questions (FAQ)

Q: Is WavePay only available in Myanmar?

A: Yes, currently WavePay is exclusively available to users in Myanmar.

Q: What type of transactions can I perform with WavePay?

A: WavePay allows for cash transfers, bill payments, mobile top-ups, and purchases with various payment partners. It also includes microfinancing options.

Q: How secure is WavePay?

A: WavePay employs a “One Wallet, One Device” policy to enhance security and prevent unauthorized access. Users can also upgrade to a Level 2 account for increased transaction limits and enhanced features.

Q: How do I register for a WavePay account?

A: Registration requires only a mobile number and subsequent verification steps. The process is designed to be quick and easy.

Q: What are the alternatives to WavePay in Myanmar?

A: Several alternative mobile wallet services operate in Myanmar, including KBZPay and MytelPay, among others. A comparison of these platforms is recommended to determine which best suits individual needs.

Q: How can I provide feedback or report issues with WavePay?

A: The app’s developer, Wave Money, should have contact information available within the application or its website, allowing users to provide feedback or report issues encountered.

Q: Does WavePay offer customer support?

A: The availability of customer support should be clarified by checking the app or Wave Money’s website for contact information or help resources.

Q: What are the transaction limits with WavePay?

A: Transaction limits may vary depending on the user’s account level. Upgrading to Level 2 generally results in higher transaction limits. Specific limits should be checked within the application’s settings or FAQs.

Q: What languages does WavePay support?

A: While the original content mentions English, it’s crucial to confirm the available languages directly within the application to ensure accurate information. Many applications support multiple languages depending on user location.

Q: Are there any fees associated with using WavePay?

A: The existence of fees associated with transactions or other services should be verified within the application’s terms of service or by contacting Wave Money directly. Many mobile payment platforms operate on a fee-based model, therefore it’s advisable to be aware of any associated charges.

File Information

- License: “Free”

- Latest update: “November 8, 2023”

- Platform: “Android”

- OS: “Android 13.0”

- Language: “English”

- Downloads: “172.2K”

- Download Options: “Google Play”